Secret of success in bank insurance sales: digital solution decoupled from the bank’s IT

With almost 7,000 consultations since 2018 and closing rates of over 50%, the Anivo360 bancassurance solution is the most successful in Switzerland. The offering achieves the highest satisfaction scores among bank clients and bank client advisors.

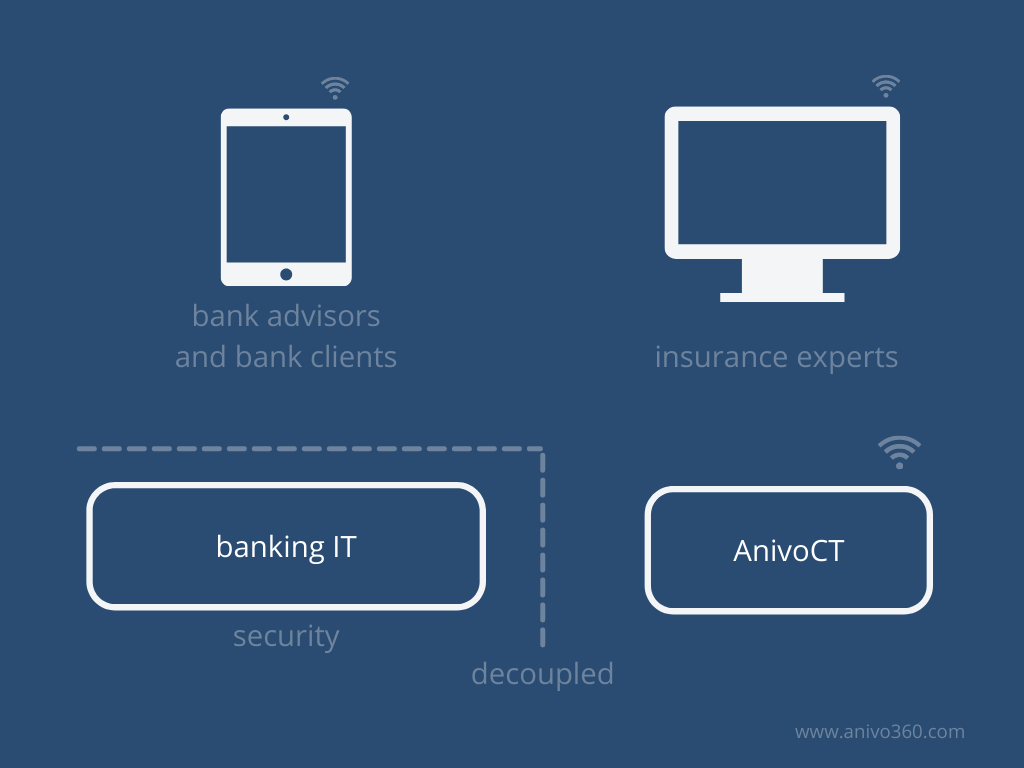

One of the secrets of success lies in the IT system architecture: the digital bancassurance solution AnivoCT is completely detached from the bank IT. Complex integration is not necessary. Technical and regulatory hurdles are eliminated. Reading time: 1 minute

AnivoCT is the digital backbone of the Anivo360 end-to-end solution for bank insurance sales. The secure operation of the software-as-a-service (SaaS) is carried out by a Swiss internet service provider. The provider has the necessary accreditation for hosting financial systems. Alternatively, on-premise operation on a server of the bank is possible. Access is very simple for all participants by means of a browser. All hardware required is a tablet PC and an internet connection.

This architecture enables complete decoupling from the bank’s IT while allowing integration into the bank’s counselling processes.

As a result, the following technical hurdles are solved:

- Clients of bank advisors and the technical equipment of bank counselling rooms are generally not suitable for video telephony.

- Bandwidth requirements for video telephony are often not sufficiently met.

- Firewall adjustments (IP, ports, release of audio & cam in the advisors’ browsers) for holding video telephony sessions repeatedly cause problems

Highlights of the solution

- The Anivo360 tablet solution meets the IT security requirements of ISO-IEC-27.002 and enables a cost-effective and very short term launch of bank insurance sales.

- Bank advisors have full access to all required data and processes via a dashboard: Planning, execution and analysis of insurance consultations for their clients.

- The bank offers its clients a unique advisory experience at the bank branch, embedded in its own banking advisory processes.

As an expansion stage, the advisory experience can be further optimised for bank clients through the use of large screens in the bank’s advisory rooms.

Conclusion

The AnivoCT system architecture is particularly popular with bank CTOs, as there is no need to intervene in or interface with core bank systems. This minimises the effort required. Bank CSOs, on the other hand, appreciate the fast and flexible launch to increase customer loyalty.